Investment Strategies of the Wealthy

(7 minute read)

How the Top 1% Grow and Protect Their Wealth

When it comes to building and sustaining wealth, the top 1% operate differently from the average investor. Their strategies are not only

focused on wealth accumulation but also on preservation and long-term growth. A recent report by Goldman Sachs, based on U.S. Federal

Reserve data, reveals that the wealthiest individuals allocate a staggering 61% of their wealth to one asset class: equities. Meanwhile, the

bottom 50% of the population primarily invest in real estate, holding around 55% of their wealth in property. So, what lessons can everyday

investors learn from the affluent? Let’s dive into the key investment strategies of the wealthy.

1. Prioritising Equities Over Real Estate

The ultra-rich overwhelmingly favour stocks over real estate. Why? Stocks offer:

-

Liquidity – Unlike real estate, equities can be bought and sold quickly, allowing for fast portfolio adjustments

and access to cash when needed.

-

Transparency – Stock market prices are updated in real time, making it easier to assess asset values and make

informed decisions.

-

High Yield Potential – Historically, stocks have outperformed real estate in terms of returns, especially over

long-term investment horizons.

-

Low Maintenance – Unlike real estate, equities require no property management, repairs, or tenant oversight,

making them a hassle-free investment.

-

Tax Efficiency – Capital gains tax rates and tax-efficient investment vehicles like index funds and ETFs make

equities a favourable choice for long-term growth.

While real estate is still an important asset class, it often requires more capital, incurs significant transaction costs, and lacks

liquidity compared to equities. That said, many wealthy individuals still invest in real estate but often focus on commercial properties,

rental units, and real estate investment trusts (REITs) to maximise returns while minimising hands-on management.

2. Diversification with Alternative Investments

Beyond stocks and real estate, the wealthy also invest in alternative asset classes, such as:

-

Private Equity & Venture Capital – Investing in start-ups and private companies like search funds provides high-growth

opportunities, often yielding significant returns when successful.

-

Hedge Funds – These funds use advanced strategies, such as short-selling, derivatives, and arbitrage, to generate returns

in all market conditions, reducing overall risk exposure.

-

Commodities & Precious Metals – Gold, silver, and other commodities act as hedges against inflation and

economic downturns, ensuring portfolio stability.

-

Art & Collectibles – Fine art, vintage cars, and rare collectibles often appreciate over time and provide

portfolio diversification while serving as tangible stores of value.

Alternative investments provide an additional layer of protection against stock market volatility and economic downturns. While they require

specialised knowledge and higher initial capital, they are valuable tools for wealth preservation and expansion. They are often

chosen as part of an "all weather" portfolio which means the assets are uncorrelated.

3. Taking Advantage of Tax-Efficient Strategies

The wealthy optimise their investments to minimise taxes through various strategies, including:

-

Capital Gains Optimisation – Holding assets for more than a year to benefit from lower long-term capital gains tax

rates and using tax-loss harvesting to offset gains.

-

Trusts & Estate Planning – Using legal structures, such as irrevocable trusts and family limited partnerships, to

pass wealth efficiently to the next generation while reducing estate taxes.

-

Tax-Advantaged Accounts – Utilising Superannuation funds, Self-Managed Super Funds (SMSFs), and other tax-advantaged

accounts to defer or reduce tax liabilities.

-

Charitable Giving – Donating to foundations, donor-advised funds (DAFs), and charitable remainder trusts (CRTs) to

support philanthropic causes while receiving tax deductions.

-

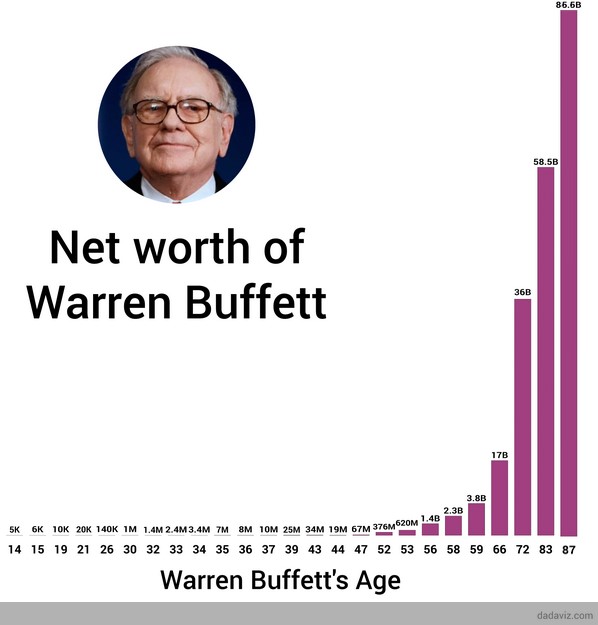

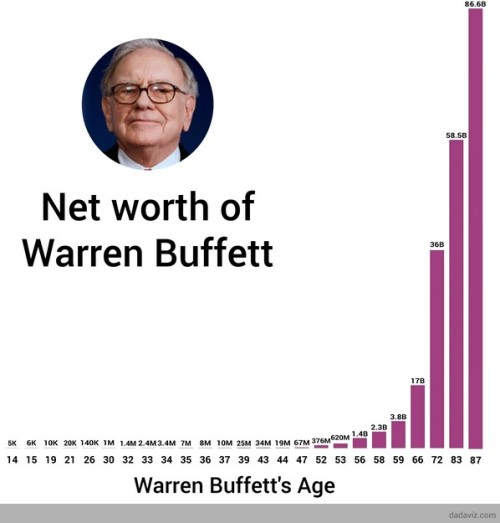

The Power of Compounding - by thinking long term and minimising transaction costs and CGT, these wealthy investors

understand the power of compounding. See below for Warren Buffett example.

By employing these strategies, the wealthy keep more of their investment gains, ensuring that their wealth continues to grow and is

preserved across generations.

4. Leveraging Debt Wisely

While debt can be risky for average investors, the wealthy use leverage strategically to amplify returns. They often:

-

Take low-interest loans to invest in high-yielding assets, using borrowed money to generate higher returns than

the cost of borrowing.

-

Use real estate mortgages to acquire appreciating properties without tying up all their capital, thus improving

cash flow and maintaining liquidity.

-

Borrow against stock portfolios through securities-based lending instead of selling, allowing them to defer

capital gains taxes while maintaining market exposure.

-

Employ margin investing selectively, using borrowed funds to enhance investment returns while managing risks

effectively.

By managing debt intelligently, the wealthy create opportunities for greater returns without sacrificing liquidity or taking on excessive

financial risk.

5. Long-Term Mindset & Patience

Perhaps the most crucial factor in wealthy investing is a long-term perspective. The wealthy:

-

Avoid short-term market panic and focus on underlying business fundamentals rather than daily market

fluctuations.

-

Reinvest dividends and capital gains to compound wealth over time, leveraging the power of exponential growth.

- Hold assets for decades, taking advantage of economic cycles and benefiting from long-term appreciation.

-

Trust in financial advisers and wealth managers to guide their investment decisions, ensuring strategic asset

allocation and risk management.

The ability to withstand market fluctuations and think in terms of decades instead of months is a key differentiator between the wealthy and

the average investor.

Key Takeaways for Everyday Investors

While not everyone has access to hedge funds or venture capital, there are valuable lessons that anyone can apply:

-

Consider increasing exposure to equities for long-term growth, using index funds or ETFs for diversified

exposure.

-

Diversify your portfolio beyond just real estate—look into alternative assets that align with your risk tolerance

and financial goals.

-

Take advantage of tax-advantaged accounts to build wealth efficiently and minimise tax liabilities e.g. SMSF's &

Investment Bonds.

-

Use debt wisely—don’t overleverage, but explore opportunities where borrowing can generate additional returns.

-

Invest with patience—focus on long-term gains rather than short-term market moves, allowing time for wealth to

compound.

By adopting these principles, everyday investors can start building a more robust and resilient investment strategy similar to that of the

ultra-wealthy.

If you’re ready to take your business to the next level and get out of reactive mode, let’s chat. Reach out to us at

hello@accountica.com.au with the subject line “Private,” and we’ll help you build the business of your dreams.

Here are a few ways we can help you

-

Sign up for our Newsletter where we

provide free actionable advice for business owners.

-

Follow us on Linkedin, Instagram or Tiktok

-

Work with me and my team privately. Schedule an obligation-free chat if

you want to work ON your business, not IN it!

The information on this website is general in nature and does not consider your personal situation. You should consider whether

the information is appropriate to your needs and, where appropriate, seek professional advice.